Chase, wells fargo, and bank of america overdraft fees are based on their respective websites as of september 15, 2021. Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements.

Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month.

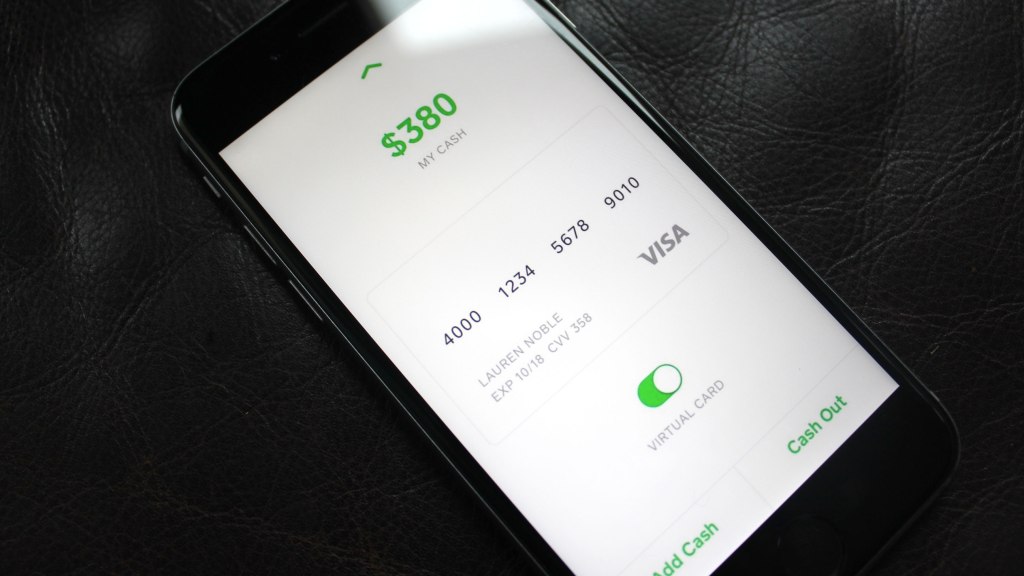

Cash app overdraft fee. If you are sending money via a credit card linked to your cash app , a 3% fee will be added to the total. Everyone 13+ can manage money securely. With chime’s spotme service, you can overdraw your account by up to $20 on debit card purchases.

Get instant discounts with boosts. It’s free to use cash app for personal use (not business). Repay the instant advance with your next paycheck.

So, for the most part square cash is free to use, but square cash will pass credit card merchant charges on to you if you send money with your credit card as funding source. The cash app instant transfer fee is 1.5%, with a minimum of $0.25. You pay 1% if you request an instant withdrawal.

On the other hand, if you want your money transferred instantly, then you’ll have to pay a fee. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Established in 2013, this bank has one of.

0.5% apy on savings accounts. So sending someone $100 will actually cost you $103. Sending money using your credit card as funding source incurs a 3% fee which is paid by you.

Design your own debit card. Only after it came out other apps like dave started to show up. Consider the investment objectives, risks, fees, and expenses of a fund before investing.

Chime is an industry leader in the digital banking world. All investments involve risk and the past performance does not guarantee future returns. Cash app is starting out by offering loans for any amount between $20 and $200.

Dave is probably the first app of its kind to directly address the overdraft fees problem. With a cash app instant transfer, your money will be transferred instantly to your linked card.¹ Just tap your available balance in the cash app, tap the boost icon and select a boost.

Download to see if you qualify for albert instant. You need to activate cash boost but doing so is simple. Chime and its banking partners are not like most banks.

The app will automatically warn you as you get close to going into an overdraft, which is great because it helps you to avoid overdraft charges. In many cases, using alternative solutions and overdraft apps protection will be much cheaper. The cash app terms of service govern your use of cash app.

By using cash app you agree to be bound by these terms, and all other terms and policies applicable to each service. And we all know that banks charge super high fees when you overdraft. We also do not require you to link your savings account to your spending account or charge you a fee to participate in spotme.

Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Does not charge overdraft fees.

Cash out speed options cash app offers standard deposits to your bank account and instant deposits to your linked debit card. We believe in having our member’s backs and will allow you to overdraft up to $200* without charging a fee. With dave you can borrow up to $75 at a time.

Instant deposits are subject to a 1.5% fee (with a […] And unfortunately, things have only grown worse during the pandemic. If you need your cash instantly, a 1.5% fee will apply.

When you cash out on cash app does it go to your bank account? You’ll be expected to pay the loan back in four weeks, along with a flat fee of 5%. ^ savings bonus of 3% (annualized) is paid on all amounts in savings account (including pots linked to savings account and teen savings account).

Cash boost is the cash program that gets you discounts (either a percentage or fixed dollar amount) whenever you pay at an eligible merchant using your cash card. Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. Does not charge overdraft fees.

Fees hit record highs in 2021, with the average overdraft fee coming in at just over $33.

0 comments:

Post a Comment